It proposes bills to Congress on monetary policy. The Federal Reserve keeps.

Departments U S History Staar Released Test Questions

Is responsible for monetary policymoney supply.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Role_of_the_Fed_Jun_2020-01-02efe1c99128421195f2a3c68737d792.jpg)

. It prints all the paper money in circulation in the United States. Keeps the country out of debt. Which of these best describes the US.

Why does the Federal Reserve Bank of New York play a special role within the Federal Reserve System. Helps people in need. Although the Fed board members are appointed by Congress it is designed to function independently of political influence.

Which statement best describes the Federal Reserves current level of transparency to the American public. Economy and more generally the public interest. Compare the functions of the federal reserve district banks with those for the board of governors.

The Fed is somewhat transparent with regard to some aspects of monetary policy. The Federal Reserve System is the central bank of the United States. It performs five general functions to promote the effective operation of the US.

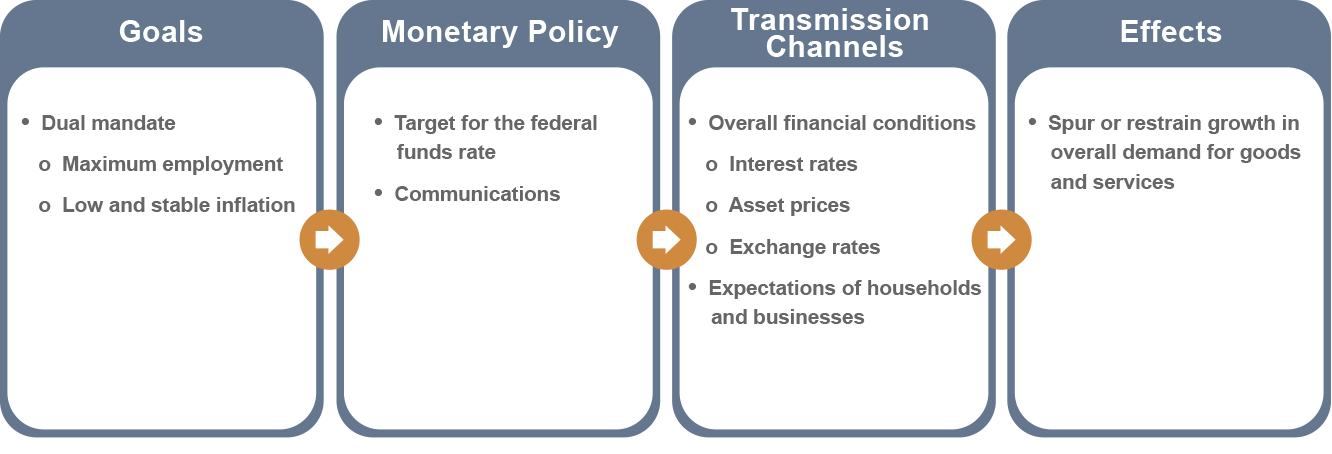

Board of Governors of the Federal Reserve System. Monetary policy in the United States comprises the Federal Reserves actions and communications to promote maximum employment stable prices and moderate long-term interest rates--the economic goals the Congress has instructed the Federal Reserve to pursue. Other sets by this creator.

Which statement best describes the roles of the federal reserve The Federal Reserve directs monetary policy sets interest rates and provides banking services for commercial banks. The Federal Reserve provides lending directly to consumers businesses and other banks. The actions of the Fed are largely carried out in secrecy with little regard to public transparency.

The job of the Federal Reserve System is to control the supply of money in the United States. The federal reserve provides loans to banks that cannot obtain loans to prevent shortages in cash. The Federal Reserve System also known as the Federal Reserveand informally as the Fed is the central banking system of theUnited StatesThe.

Dodd-Frank the Emergency Economic Stabilization Act and steps taken by the Federal Reserve were key components in responding to the 2008 financial crisis. The Federal Reserve performs a number of key functions that are designed to enable a safe efficient and stable national payment system which in turn allows for various financial transactions to take place. It safeguards the US research of gold bullion.

The federal reserve prints the currency for the US and controls the amount of money in circulation D. Dodd-Frank amended many. The Federal Reserve Bank manages the US.

Treasury prints paper and coin currency and the Federal Reserve System distributes the money globally. The Federal Reserve is the central bank of the United States. It safeguards the US.

What BEST describes this statement The States are actually the most important players in the. Economy by controlling the money supply. It controls the supply of money in the United States C.

The Federal Reserve directs monetary policy sets interest rates and provides banking services for commercial banks. Who sets monetary policy in the United States. The Federal Reserve helps the economy by keeping inflation low in times of economic growth.

The Federal Reserve controls the value of the dollar by setting prices for basic goods and services like food. The federal reserve provides lending directly to consumers businesses and other banks B the federal reserve directs monetary policy sets interest rates and provides banking services for commercial banks. When the Fed adjusts its interest rate it directly influences consumer.

It proposes bills to congress on monetary policy. Monetary policy involves decreasing the money supply. Which best describes one of the ways in which the Federal Reserve has an impact on the national economy.

Storing money for banks. Determine the statement that best describes the role of the federal reserve district banks. The Fed manages inflation regulates the national banking system stabilizes financial markets protects consumers and more.

Who owns the securities at the Federal Reserve. Ensuring there is an adequate supply of paper currency around the country. Which statement describes the role of the Federal Reserve System.

The Federal Reserve directs fiscal policy for the financial government sets interest rates and regulates the banking industry. Feds System Tools and Monetary Policy Quick Check. Which statement best describes the bartleby.

The Federal Reserve controls the health of the economy by setting demand for goods and services. Determine the statement that best describes the role of the Federal Reserve District banks1 point The district banks overlook the commercial banking industry and implement the policies from the Board of Governors and the Federal Open Market Committee The district banks overlook the commercial banking industry and implement the policies from the. Conducts the nations monetary policy to promote maximum employment stable prices and moderate long-term interest rates in.

None of the above 2. Reserves of gold bullion. Which statement describes the role of the federal reserve system.

None of the above 3. The Federal Reserve controls the flow of money in the United States by telling banks how much they can lend and how much they need to hold on to. Although it might seem like the Federal Reserve System prints the money as well but this is in fact not true.

It controls the supply of money in the United States. The federal reserve directs fiscal policy for the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Role_of_the_Fed_Jun_2020-01-02efe1c99128421195f2a3c68737d792.jpg)

Federal Reserve System Frs Definition

Federal Reserve Board Monetary Policy What Are Its Goals How Does It Work

0 Comments