The systematic allocation of a n assets cost less residual value over the useful life. In this situation the book value should be reduced to the market value which creates a loss in the amount of the difference.

Impairment Of Assets What It Is How To Handle And More

The amount by which the carrying amount of an asset exceeds the recoverable amount c.

. IAS 36 Impairment of Assets requires that an asset is not carried at more than its recoverable amount. The higher of fair value less disposal costs and the. Impairment testing is to be conducted at regular intervals so a.

PAS 36 has an exhaustive list of external and internal indicators of impairment. If the carrying amount exceeds the recoverable amount the asset is described as impaired. The amount by which the carrying amount of an asset exceeds the recoverable amount.

It is acquired through the purchase of another business entity. The removal of an asset from an entitys statement of financial position b. What is an Impaired Asset.

The Standard also specifies when an entity should reverse an impairment loss and prescribes. Smallest identifiable group of a ssets that generates. An impaired asset is one that has a book value less than its market value.

The systematic allocation of an assets cost less residual value over its useful life d. Asset Impairment Asset Depreciation. The cost of an impaired building beyond repair is disclosed as a loss on the income statement.

Physical impairment of parts of the asset only Deterioration of the asset only Inadequacy of the asset in performing its functions only All the above. An indication that an asset may be impaired may indicate that the assets useful life depreciation method or residual value may need to be reviewed and adjusted. Which of the following BEST describes when an asset should be replaced.

Which of the following best describes recoverable amount. According to PAS 36 Impairment of Assets which of the following terms is defined as. The higher of the present value of all future cash flows associated with the asset for the rest of its useful life and fair value.

The amount by which the recoverable amount of an asset exceeds its carry ing amount. It can be established that a definite benefit or advantage has resulted to an entity from some item such as a good name capable staff or reputation. Impairment loss An impairment loss is the amount by which the carrying amount of an asset or a cash-generating unit exceeds its.

If the impairment is permanent is must be reflected in the financial statements. Under PAS 36 Impairment of assets which of the following statements best describes the term impairment loss. An impaired asset is an asset that has a market value less than the value listed on the companys balance sheet.

Which statement best describes impairment loss. An asset is carried at more than its recoverable amount if its carrying amount exceeds the amount to be recovered through use or sale of the asset. Based on the.

Generally an impaired asset is an asset whose market value is below book value. Asset depreciation is the method used to find out the cost of a tangible asset over its years of service. The amount by which the recoverable amount of an asset exceeds the carrying.

The impairment of an asset reduces its value on the balance sheet. For an example take a retail store that is recorded on the owners balance sheet as a non-current asset worth USD 20000 book value or carrying value is USD 20000. The systematic allocation of an assets cost less residual value.

What amount of impairment loss should Mallory record for. The removal of an asset from the statement of financial position. How Does an Impaired Asset Work.

It is purchased from another entity. Fixed assets and goodwill are the assets most commonly experiencing impairment write downs. Generally an asset impairment occurs when a company 1 pays more than book value for a set of assets and 2 later lowers the value of those assets.

The removal of an asset from the statement of financial position b. Assets are considered impaired when the book value or net carrying value exceeds expected future cash flows. 17 If there is an indication that an asset may be impaired this may indicate that the remaining useful life the depreciation amortisation method or the residual value for the asset needs to be reviewed and adjusted in accordance with the Standard applicable to the asset even if no impairment loss is recognised for the asset.

Up to 10 cash back The Mallory Corp has a fixed asset with a carrying value of 100000 expected future cash flows of 90000 present value of expected future cash flows of 70000 and a market value of 75000. PAS 36 has an exhaustive list of external and internal indicators of impairment. The amount by which the carrying amount of an asset exceeds its recoverable amount c.

According to PAS 36 Impairment of Assets which of the following terms is defined as. The amount by which the carrying amount of an asset exceeds its recoverable amount c. Economics questions and answers.

A loss in the future economic benefits or service potential of an asset over and above the systematic recognition of the loss of the assets future economic benefits or service potential through depreciation. If this is the case the asset is described as impaired and the Standard requires the entity to recognise an impairment loss. The systematic allocation of cost of an asset less residual value over the useful life d.

The core principle in IAS 36 is that an asset must not be carried in the financial statements at more than the highest amount to be recovered through its use or sale. Which of the following statements best describes the term impairment loss. The entity must reduce the carrying amount of the asset to its recoverable amount and.

Impairment results when theres a drastic decrease in the market value of an asset. The amount by which the recoverable amount of an asset exceeds its carrying amount 4. Asset impairment is the permanent reduction in the value of both tangible and intangible assets.

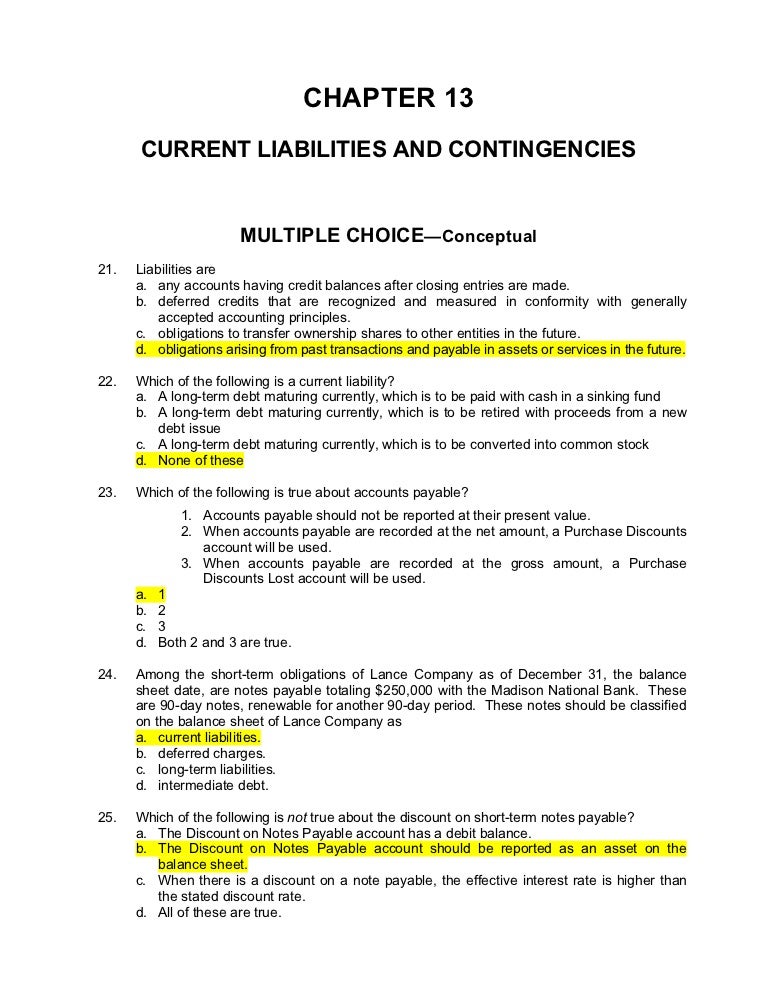

Pas 40 Multiple Choice Questions On Investment Property A Property That Is Held By A Lessee Under Studocu

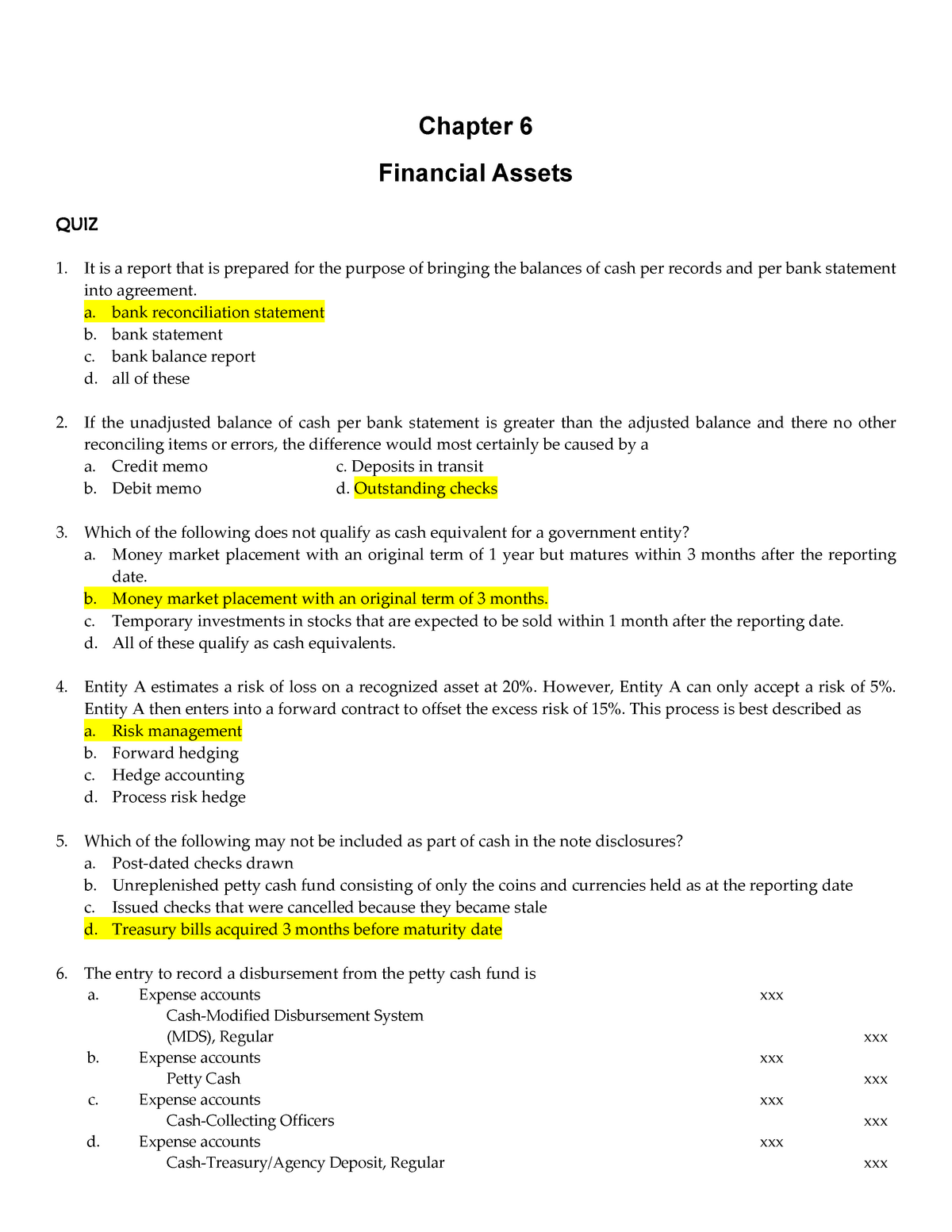

Final 21 December 2018 Questions And Answers Chapter 6 Financial Assets Quiz It Is A Report That Studocu

0 Comments